Q1 2021 M&A Update: The market remains bullish

M&A activity in the Knowledge Economy during Q1 has provided confirmation of the expectations and trends our team expounded in both our 2020/21 Buyer’s Report and M&A Trends Report.

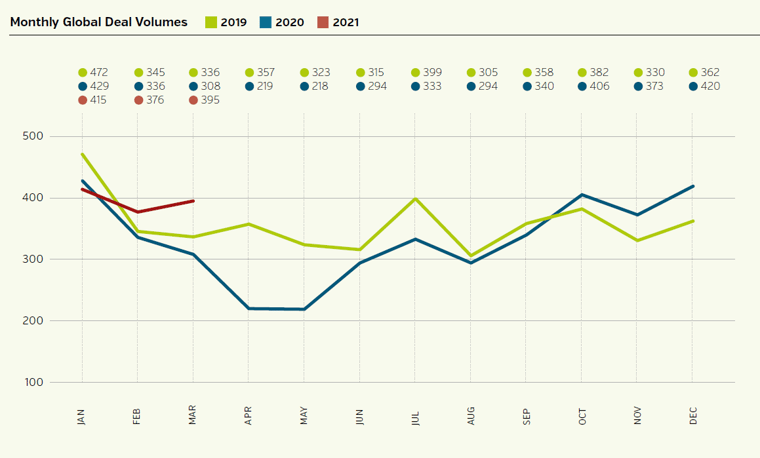

This ever-increasing interest of buyers – and in particular of financial investors – in the Knowledge Economy led to a 10% year-on-year growth in deal volumes during Q1, a total of 1,186 deals, up from total of 1,073 and 1,153 in 2020 and 2019 respectively.

Such activity, hot on the wheels of a 2020 dogged by uncertainty, arrives amid strong valuation tailwinds and record levels of dry powder. Combined, these factors drove an almost 40% year-on-year increase in the number of deals completed by financial buyers.

The market remains bullish and consistent, year-on-year transaction values of $52bn in Q1 20201 (against $51bn in 2020) have been led by a number of mega-deals, including Wipro’s acquisition of Capco for $1.5bn, Hitachi's $9.6bn acquisition of GlobalLogic (~40x EBITDA), and Workday’s acquisition of Peakon for $700m – a multiple figure north of 20x revenue.

Of course, segments differ in their performance throughout the Knowledge Economy, especially across regions. For example, management consulting deals grew in number by almost 50% year-on-year in Europe, despite staying flat or falling elsewhere. The tentative reopening of international travel has helped pave the way for large year-on-year increases to deal volume across the HCM, IT Services and Software sectors in North America. While in Asia Pacific, the overall number of deals stayed flat or fell year-on-year in all sectors except Software, which saw a 60% increase.

After a year of pivoting to develop new, more digital ways of working, the activity of buyers within the Knowledge Economy during Q1 only serves to reaffirm how quickly the market has had to accelerate the digital transformation agenda – and suggests that we can expect the sector to go from strength to strength.

Download the full report, M&A activity in Knowledge Economy Q1 2021, for an overview of the following sectors:

Software & Tech-enabled Services

“Tech M&A volume hit even higher levels in Q1, following a great Q4 last year”

Technology Services & Outsourcing

“The most appealing opportunities lie with technology partners present on government frameworks or reside in the ecosystems of dominant platforms”

Management Consulting

“Buyers in the management consulting space are amongst the most active we have seen during Q1”

Engineering Consulting & Services

“Big engineering firms are taking note of this and prioritizing the environmental agenda in pure-play acquisitions”

- Read our blog on Equiteq’s perspective on sustainable investing within this space.

- Equiteq is speaking on the M&A panel at Environmental Analyst Business Summit – 16 June 2021. Register to the Global Summit or UK Summit to watch the discussion live and network with us.

Human Capital Management

“Increased deal activity continues to be driven by remote working trends that have grown from temporary solutions into fundamentally entrenched changes to the working world”

Marketing, Communications & Information Services

“New ways of working and more digital go-to-market strategies have driven much of Q1’s buy-and-build activity in the sector”

Want to discuss how this may impact your business? Get in touch with Our Team.